In 2022 Decentralised Finance hyped credit protocols such as Maple.finance. They promised democratized undercollatoralized loans by bringing credit worthiness on-chain, then it all collapsed.

Trustlessness is a DeFi feature not a bug

Trustlessness is a key concept in decentralised finance (DeFi) and cryptocurrency. It refers to the ability of a system or process to operate without requiring trust in any specific individual or entity. In other words, trustlessness means that the system or process can function without relying on any particular person or organization to behave in a trustworthy manner.

In the context of DeFi and cryptocurrency, trustlessness is important because it allows users to interact with the system without having to trust any particular counterparty. This can be especially important in financial systems, where trust in intermediaries such as banks and financial institutions is often required. By eliminating the need for trust in these intermediaries, decentralised financial systems allow users to retain control over their own assets and transactions.

Another reason why trustlessness is important in DeFi is that it helps to ensure the security and integrity of the system. In a decentralised system, there is no single point of failure that could be targeted by attackers. This makes it much harder for malicious actors to compromise the system and steal funds or manipulate transactions.

In traditional finance, trust is often an important aspect of financial transactions and interactions. For example, when you deposit money in a bank, you are trusting the bank to keep your money safe and to use it responsibly. Similarly, when you borrow money from a lender, you are trusting the lender to lend you the money and to expect repayment according to the terms of the loan.

Traditional financial institutions, such as banks and other lending institutions, are subject to a wide range of regulatory requirements and oversight to ensure that they operate in a safe and sound manner. This includes legislation that establishes minimum capital requirements, sets standards for risk management, and requires financial institutions to follow certain practices and procedures to protect customer assets.

In addition to legislation, financial institutions are also subject to audits and other forms of regulatory oversight to ensure that they are complying with all relevant laws and regulations. Auditors review the financial records of financial institutions to ensure that they are accurate and complete, and compliance officers are responsible for ensuring that the institution is following all relevant laws and regulations.

All of these measures are in place to ensure that financial institutions can be trusted to handle the large sums of money and assets that are entrusted to them. Trust is a crucial component of the financial system, and financial institutions must work to maintain the trust of their customers, regulators, and the general public in order to continue operating effectively.

In contrast, cryptocurrency relies on decentralized networks and consensus protocols to facilitate transactions and manage assets. This means that there is no central authority or intermediary controlling the system, and transactions are processed and validated by the network as a whole. This decentralized structure makes it more resistant to fraud, censorship, and other risks, as there is no single point of failure.

Overall, the fact that cryptocurrency does not rely on trust in the same way that traditional financial systems do is one of its key advantages, as it allows for greater security, transparency, and decentralization.

The cost of minimal trust

Why was the trustless person always late to meetings?

Because they had to verify the time on three different blockchains before they could leave their house!

In a financial system where trust is minimized, the onus is on users to verify the authenticity and security of the transactions and smart contracts that are recorded on the blockchain. This can be a significant burden for users who are not familiar with the technical details of blockchain and smart contracts, as they may need to invest time and resources to understand and verify the information that is being recorded on the blockchain.

To address this issue, some cryptocurrency protocols invest in third-party audits for smart contract design and security, as well as proof-of-reserves to demonstrate that they have the assets that they claim to have. These measures can help provide additional assurances to users that the protocol is operating in a safe and secure manner.

However, it’s important to note that even with these measures in place, users still need to be vigilant and do their own due diligence to ensure that they are comfortable with the security and reliability of the cryptocurrency protocol they are using. Trustlessness does not completely eliminate the need for users to take responsibility for their own security, but it can help reduce the reliance on trust in intermediaries and central authorities.

Overall, while the lack of trust in the cryptocurrency system does come with some drawbacks, the advantages of greater security, transparency, and decentralization outweigh these disadvantages for many users.

Maple.finance: on-chain credit worthiness but not trustworthiness

In 2022, the post-2021 DeFi hype still has some dry powder to pump valuations of credit protocols sky-high: capital efficient lending was the game and Maple.finance, Goldfinch, TrueFi was the name.

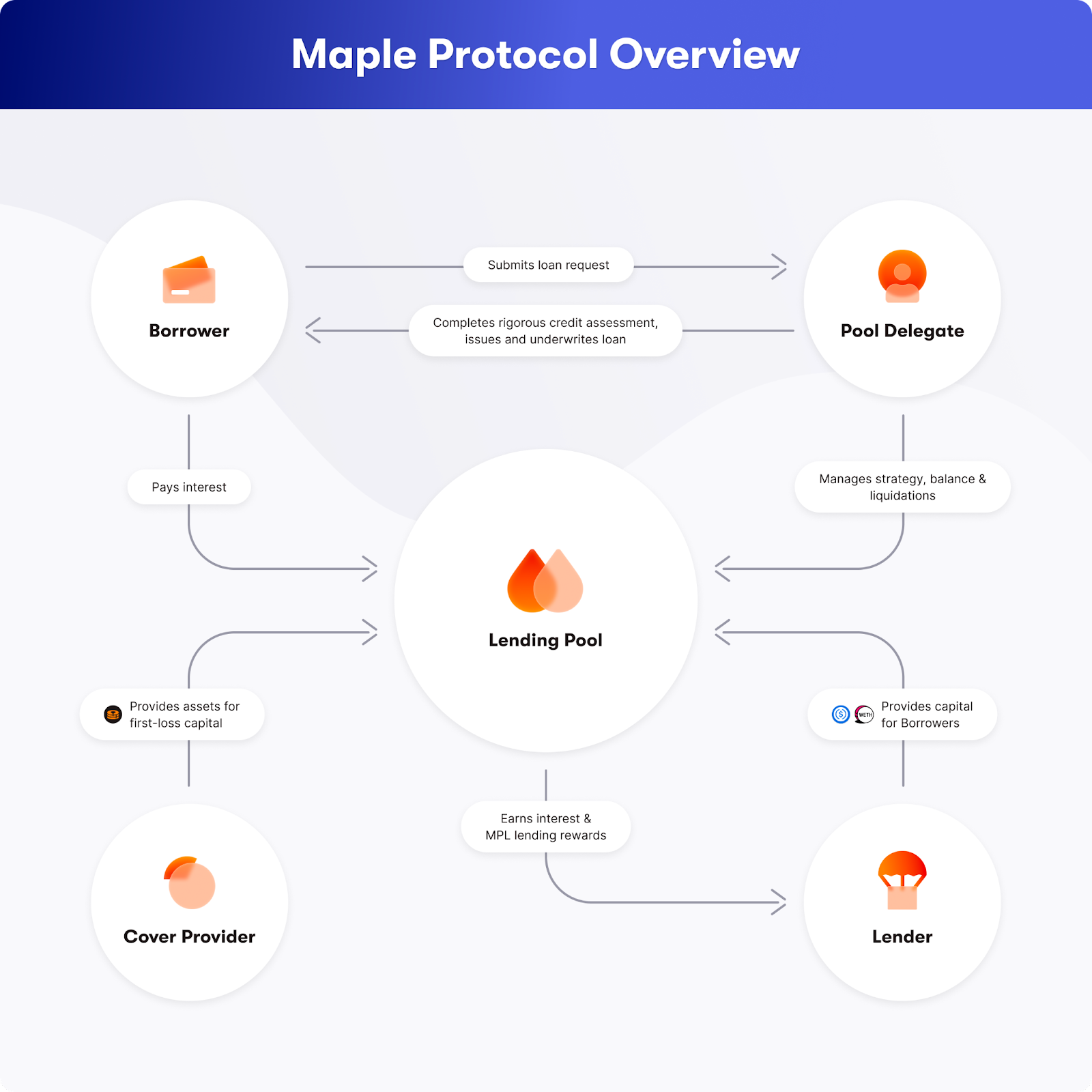

Our story focusses on Maple.finance being the one to do away with the stuffy old overcollateralized lending in DeFi: They would serve crowd-funded “undercollateralized” credit to institutional players. Maple’s model would not require extra cryptocurrencies to be deposited as collateral that could be seized or quickly liquidated in the event of a default. Instead, underwriters of various lending “pools” would make the decision on whether to grant loans – essentially evaluating the borrower’s ability to pay based on their creditworthiness alone.

While the founder often carefully speaks of “undercollateralization”, Maple credit pools are in-practice pure-sang unsecured loans. Maple borrowers often post nothing at all to secure a loan; like a mortgage without a lien on the home.

As of 10th December 2022, Maple.finance accrued $54 million of distressed debt in the last two weeks as two of its borrowers, Auros Global and Orthogonal Trading became insolvent due to contagion of the implosion of FTX.

Maple.finance roles and basic credit design. source: maple.finance

Maple severed ties with crypto firm Orthogonal Trading, alleging that it was “misrepresenting its financial position.” The move came after Orthogonal was due to pay back a $10 million USDC stablecoin loan from a credit pool managed by M11 Credit on Dec. 4. Orthogonal has been a significant borrower on Maple, and also was a manager and underwriter of a credit pool on Maple. Source: Coindesk

It turns out the trusted party Orthogonal Trading not only misrepresented their insolvency, but also engaged in risky trading in an attempt to gain much needed capital but incurred deeper losses in the process.

Now, I don’t have to tell you it is horribly naive to have one party be a major borrower and underwriter on the same platform. Electronic financial systems are ripe targets for hackers and miscreants due to the relative anonymity and massive scale. Add in a burgeoning industry filled with profit-seekers where degenerate gambling is touted as a virtue and you have no place for trust.

Traditional finance provides an age-old framework for financial services that require trust with all its slow and costly processes, legal and compliance regulations and consumer protections. There is no added value in reinventing the wheel but on the blockchain as it will bring with it all the disadvantages of TradFi: KYC, compliance, transaction delays, full government oversight, increased friction everywhere.

Keep crypto dangerous and DeFi trustless.